Drug companies are putting patients and hospitals at risk

The Rebate Scheme Threatens 340B Hospital Stability

Bristol Myers Squibb, Eli Lilly, Johnson & Johnson, Novartis, and Sanofi want to replace upfront 340B discounts with back-end rebates, forcing hospitals to:

- Pay full price for critical drugs upfront and experience significant cash-flow issues

- Incur costs to implement rebates, including staff to submit extensive claims data

- Wait for reimbursements at drugmakers’ discretion and forego discounts for inappropriately denied claims

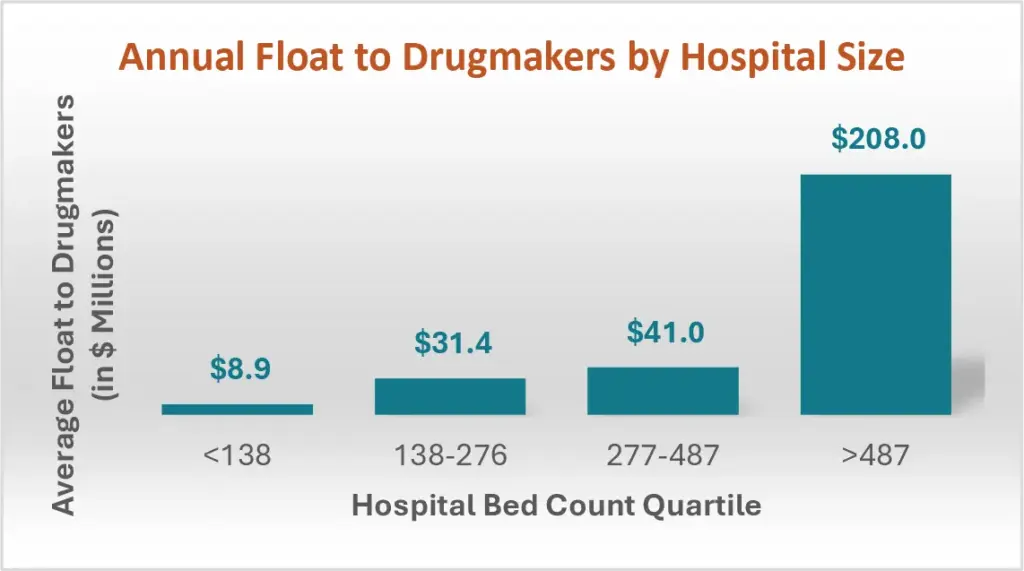

Requires Hospitals to Float Millions to Drugmakers

The average annual “float” per 340B hospital, reflecting the higher cost of purchasing all 340B drugs at wholesale acquisition cost:

| Disproportionate Share Hospitals | $72.2 million |

| Rural Referral Centers | $33.9 million |

| Children’s Hospitals | $30.6 million |

| Critical Access Hospitals | $1.7 million |

Among DSH hospitals, the average annual float could be $8.9 million for hospitals with fewer than 138 beds to $208 million for hospitals with more than 487 beds.

Puts Low-Income and Rural Patients at Risk

If all of 340B shifts to rebates, hospitals’ ability to provide care will suffer:

- 92% expect access to low-income and rural patients will decline

- 93% expect current levels of uncompensated care will be at risk

- 94% expect they will be forced to reduce services that operate at a loss

Risks Hospitals’ Finances and Operations

Total costs associated with rebate schemes, including administrative burden and denials for legitimate claims, threaten 340B hospitals’ finances and operations as well as their ability to stay open.

- 77% may be forced to close if rebates replace discounts

- 86% expect negative effects on staying, such as postponed hirings and layoffs

Bottom Line: Drugmakers’ 340B rebate scheme isn’t reform, it’s a revenue grab. Get the real facts. Read the full report .